Asset Management & Operational Optimisation

International standard feasibility studies

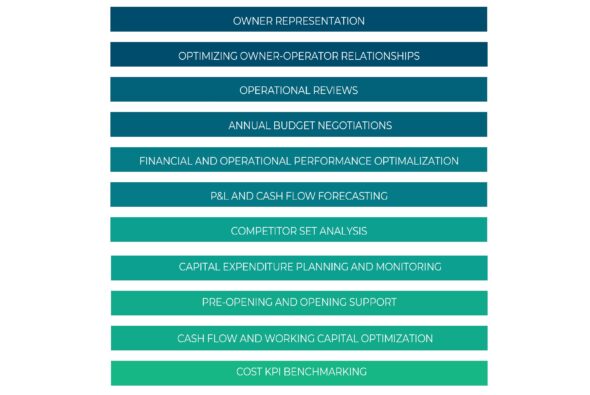

At Moore, we deliver tailored asset management solutions to maximize profitability, value, and long-term potential in hospitality investments.

Our team of hotel specialists works closely with owners and investors to enhance financial and operational performance - whether through strategic operator partnerships, direct management oversight, or asset repositioning.

By bridging the gap between ownership and hotel operations, we provide rigorous financial oversight, strategic planning, and performance enhancements to drive sustainable growth and long-term returns.

Hospitality brand, management and lease selection & contract negotiations

The financial performance of a hotel property and thus its market value is significantly affected by the selected operator scheme and professionalism of the hotel management.

Finding a brand that truly adds value to location and product is often a professional challenge for market players. Which is the contract type that provides best support to the project; meeting expectations of both owners and financiers? A long-term lease? A franchise agreement? A management contract provided by an international hotel brand? Our Team will help you find answers that are project specific, and market validated.

We assist owners throughout the complete process, from suitable brand identification all the way to signing process.

- Brand search and selection - Identifying the optimal hotel brand from an international selection pool, ensuring strategic alignment and full-scope ownership representation.

- Contract structuring and negotiation - Conducting market and project conformity assessments for management, franchise, and lease agreements, followed by negotiation of commercial terms with hotel companies.

- Contract reviews and renegotiations - Ownership representation in contract evaluations, mediation, and restructuring, including exploring new operator partnerships or alternative agreements.

- Operator search for non-hotel assets - Advisory on operator selection and ownership representation for theme parks, leisure destinations, and other tourism-driven assets.

”The right brand and operator drive a hotel's success. We secure agreements that maximize value and protect ownership interests.”

- Dr. Márton Kovács

Managing Partner at Moore Legal Hungary

Moore ESG Advisory Services

-

Regulatory compliance & legal advisory

We outline the most important EU regulations relevant to your hospitality and real estate business sizes, ensuring your company is fully aware of its legal obligations and compliance requirements.

-

Operational & Value Chain ESG Assessment

We assist in establishing a risk assessment framework essential for stable and sustainable operations. this includes conducting materiality assessments, identifying negative economic, environmental, and social impacts across the entire value chain, and unlocking positive opportunities for long-term sustainability.

-

Green Financial Services

We provide advisory services on green financing, support for green bond issuance, development of sustainable banking portfolios, and guidance on green audits and tax compliance.

-

ESG strategy development & implementation

We help design and implement a long-term, value-driven esg strategy that reduces negative environmental, social, and economic impacts across your value chain while strengthening opportunities for positive contributions. additionally, we support stakeholder engagement and communication to foster meaningful relationships that align with your ESG commitments.

-

Sustainability reporting & ESG disclosures

We support the integration of sustainable practices, the establishment of clear reporting frameworks, and ensure compliance with Taxonomy, CSRD, CSDDD, and other regulatory directives and frameworks.

”To succeed with confidence - locally or globally - ESG should be seen not as an obligation, but as an opportunity.”

- Gabriella Huth

Partner at Moore Hungary